BRS facilitate a lot of commercial acumen training for infrastructure delivery agency staff, constructors, contractors and consultants. This education and training is important in ensuring we continue to educate owners of projects and their supply chain partners on the importance of commercial acumen in driving value for money and improve public value outcomes for their communities.

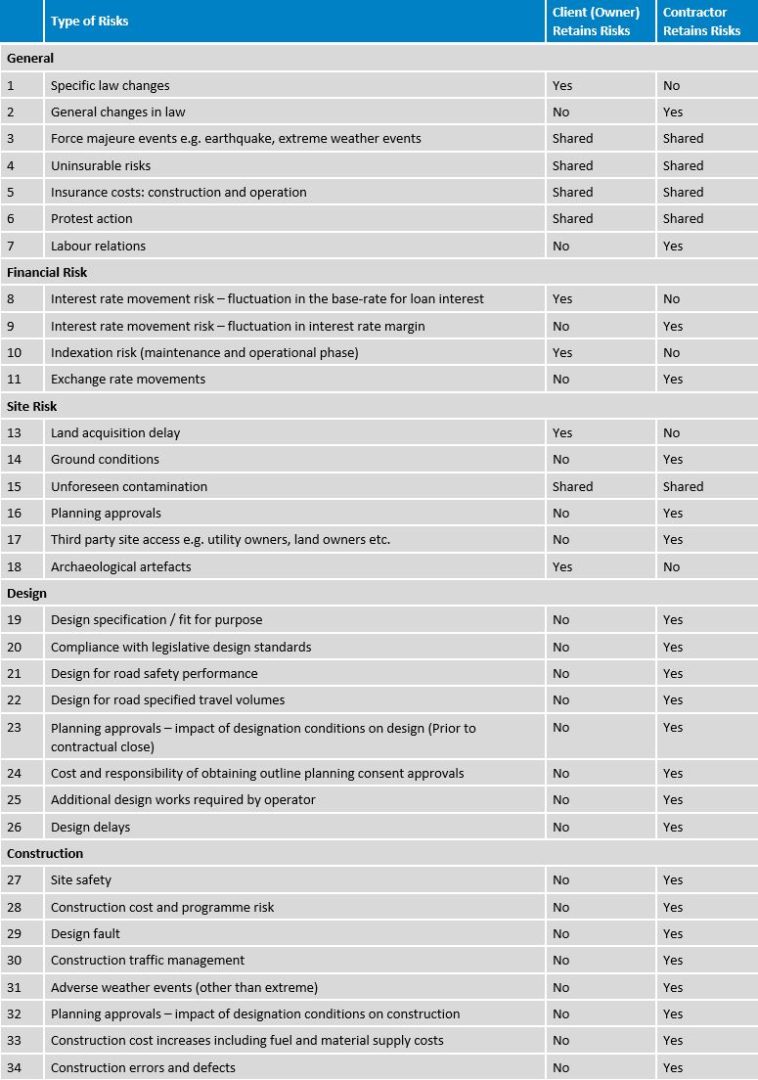

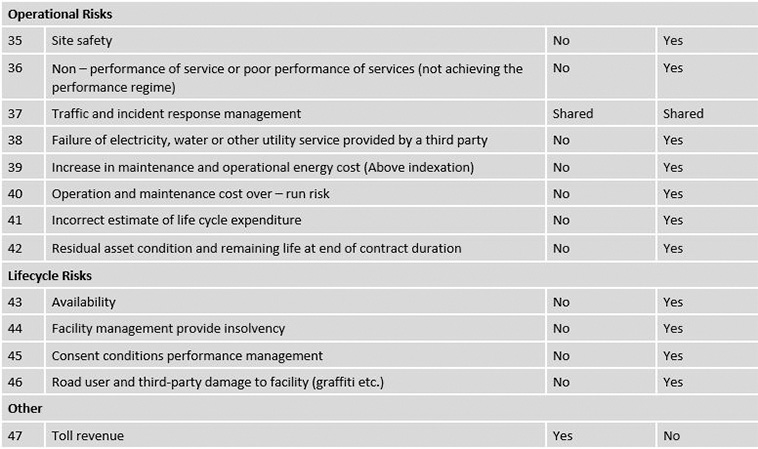

One of the fundamental training principles of every commercial acumen training course we facilitate is the importance of the risk allocation process in driving value for money outcomes from the start of the procurement of projects. This is normally translated in to a risk allocation table that is incorporated in to the tender documents as an Appendix and looks like the following example:

The risk allocation table is provided as a working draft whereby the tenderers come back to the client or infrastructure delivery agency through the procurement process prior to tender close with areas where the risk allocation table is silent or where greater value for money can be obtained if there is a reallocation of risk to the party that is best placed to manage it. This iterative process is really important in allowing the tenderers to “de-risk” their commercial offering.

In my opinion, the risk allocation table in the top 3 most important fundamental tools that need to be incorporated in to the procurement of projects. My reasons for this are as follows:

- The risk allocation table enables the client to spend time up front aligning internally on what risks there are and who is best placed to manage them. This might sound like a small point but the market often hears different messages from different parts of the client organisation. This confusion and misalignment gets priced in to the project as the tenderers are concerned with this misalignment and will price accordingly. The risk allocation process addresses this;

- If you have a draft risk allocation table to present as part of the market engagement testing with industry, it allows for discussions around innovation in terms of challenging the client’s perceptions around where the risk allocation should be with the market. It could be a potential game changer in driving value for money outcomes that industry could be aware of that we weren’t through innovation and lessons learnt when scoping up the project to present to the market;

- Risk allocation is how tenderers price your projects. Without it, you are relying on the conditions of contract and the scope/requirement documents to provide all they need to do this which is unrealistic to think we have covered all aspects of risks in these documents. A simple risk allocation table addresses this;

- Further to pricing, your goal through the procurement is to reduce the contingency and assumptions that tenderers are making when they are submitting their project costs. Risk allocation assists this in happening along with begin prepared to answer and address any qualifiers and assumptions that they raise through the procurement process;

- The outcome of a robust, transparent risk allocation table on pricing is it should lead to pricing coming back from tenderers that is a similar range of pricing rather than significant variations in pricing. This should give you certainty that they have taken in to consideration risk allocation and scope and provided a fair and value for money pricing proposal back to you;

- The more specific you can allocate risk to the party best placed to manage it, the greater opportunity you have to not play the commercial games through the tender evaluation and focus more on the non-price attributes in driving your tender decision. This is important as the non-price attributes such as safety, key personnel, methodology and project experience have more impact on the delivery of a successful project rather than pricing;

- The other important aspect to note is that the risk allocation table needs to align with the conditions of contract and any special conditions. You do not want misalignment as this will confuse the market and lead to potential ambiguity or confusion. When you update the risk allocation table through the procurement phase, the contract conditions need to be adjusted accordingly;

- The other area that is really important is to ensure you don’t have too many shared risks in the risk allocation as it is very hard for tenderers to price them particularly when you have a fixed price or lump sum procurement pricing model; and

- Where you have the challenge of too many shared risks, try to be more specific with the risk description and break it down to ensure it is very clear what the nature of the risk is but also who owns the particular specific aspect of that risk;

- The risk allocation table is also a powerful tool in the management of variations and also the commercial arrangements of the delivery of the project. A good risk allocation table accompanied by a robust project cost allocation table (which will be the subject of a future blog) then allows for a bottom up build up to variation management making it easier to analyse the additional marginal cost of the variation which is what you should only be paying for any variation.

By the end of the procurement process, you have a finalised risk allocation table that enables ‘’apple for apples” pricing from all tenderers and can be used as a very effective contract management and variation management tool as you transition in to project delivery. It is also a great sign to the supply chain that you are putting yourself in the shoes of the tenderer in understanding how they price, how they allocate risk and how it can provide additional confidence and certainty that the client they are working with is on the journey to becoming a commercially mature and intelligent client.